Join Our Groups

TOPIC 2: CORRECTION OF ERRORS

Errors are made when recording business transaction in the journal. These areas can occur because of the wring account or name. But how can we correct these errors? The process of correcting errors depend on whether or not the journal has been posted to the ledger.

Correction of Errors

How can we correct those errors? If the error is discovered before the entry is poster to the general ledger, this is simple. Neatly cross out the incorrect item and write the correct data above it. Do not erase the error, this is important to ensure honesty and a clear audit.If the error is discovered after posting a general journal to the general ledger, A correcting entry is done in the general journal and the error is journalized and posted. We do not change or erase the journal of entry or our posting in the ledger accounts.

Wrong Entries

Identify wrong entries

An accounting error is a non-fraudulent discrepancy in financial documentation. The term is used in financial reporting.

Types of accounting errors include:

- Error of omission -- a transaction that is not recorded.

- Error of commission -- a transaction that is calculated incorrectly. One example of an error of commission is subtracting a figure that should have been added.

- Error of principle -- a transaction that is not in accordance with generally accepted accounting principles ( GAAP). One example of an accounting error of principle is an expenditure that is placed in an inappropriate category.

Accounting errors can occur in double entry bookkeeping for a number of reasons. Accounting errors are not the same as fraud, errors happen unintentionally, whereas fraud is a deliberate and intentional attempt to falsify the bookkeeping entries.

An accounting error can cause the trial balance not to balance, which is easier to spot, or the error can be such that the trial balance will still balance due to compensating bookkeeping entries, which is more difficult to identify.

The Effect of Errors

Accounting Errors that Affect the Trial Balance

Explain the effect of errors on the value of stock

Errors that affect the trial balance are usually a result of a one sided entry in the accounting records or an incorrect addition.

As a temporary measure, to balance the trial balance. the difference in the trial balance is allocated to a suspense account, and a suspense account reconciliation is carried out at a later stage.

For example, suppose the trial balance showed total debits of 84,600 but total credits of 83,400 leaving a difference of 1,200 as shown below.

| Suspense Accounts – Trial Balance Difference | ||

| Account | Debit | Credit |

| Trial Balance Totals | 84,600 | 83,400 |

| Difference | 1,200 | |

| Total | 84,600 | 84,600 |

To make the trial balance a single entry is posted to the accounting ledgers in a suspense account.

| Suspense Account Posting | ||

| Account | Debit | Credit |

| Suspense account | 1,200 | |

When the accounting error is identified a correcting entry is made. Suppose the difference was an addition error on the rent account, then the correcting entry would be as follows:

| Suspense Account Reconciliation Posting | ||

| Account | Debit | Credit |

| Suspense account | 1,200 | |

| Rent | 1,200 | |

Errors Which do not Affect the Trial Balance

Accounting errors that do not affect the trial balance fall into one of six categories as follows:

- Error of Principle in Accounting

- Errors of Omission in Accounting

- Error of Commission

- Compensating Error

- Error of Original Entry

- Complete Reversal of Entries

The types of accounting errors that do not affect the trial balance are summarized in the table below.

| Summary of Accounting Error Types | |

| Accounting Errors | Description |

| Error of Principle in Accounting | Correct amount, wrong type of account |

| Errors of Omission in Accounting | Entry missed from accounting records |

| Error of Commission | Correct amount and type of account but wrong account |

| Compensating Error | Two or more errors balance each other out |

| Error of Original Entry | Correct accounts, wrong amounts |

| Complete Reversal of Entries | Correct amount and account, entries reversed |

Where possible all accounting errors should be identified and corrected, if the accounting errors are immaterial to the accounts then, as a last resort, the balance could be carried in the balance sheet on a suspense account or written off to the income statement as a sundry expense.

Preparation of Journal Entries Necessary to Correct Errors

Preparation of a Corrected Trial Balance

Prepare a corrected Trial Balance

An adjusted trial balance is a listing of all company accounts that will appear on the financial statements after year-end adjusting journal entries have been made.

Preparing an adjusted trial balance is the fifth step in the accounting cycle and is the last step before financial statements can be produced.

There are two main ways to prepare an adjusted trial balance. Both ways are useful depending on the site of the company and chart of accounts being used.

You could post accounts to the adjusted trial balance using the same method used in creating the unadjusted trial balance. The account balances are taken from the T-accounts or ledger accounts and listed on the trial balance. Essentially, you are just repeating this process again except now the ledger accounts include the year-end adjusting entries.

You could also take the unadjusted trial balance and simply add the adjustments to the accounts that have been changed. In many ways this is faster for smaller companies because very few accounts will need to be altered.

Note that only active accounts that will appear on the financial statements must to be listed on the trial balance. If an account has a zero balance, there is no need to list it on the trial balance.

Example 1

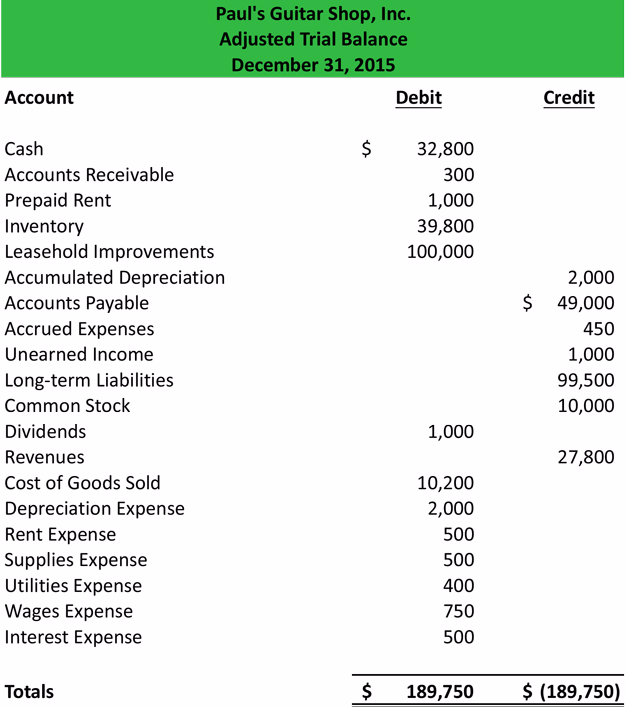

Using Paul'sunadjusted trial balanceand hisadjusted journal entries, we can prepare the adjusted trial balance.

Once all the accounts are posted, you have to check to see whether it is in balance. Remember that all trial balances' debit and credits must be equal.

Now that the trial balance is made, it can be posted to theaccounting worksheetand thefinancial statementscan be prepared.

Uses of the Trail Balance

Outline uses of the Trail Balance

Keeping in mind the definition of the trial balance we can define the following characteristics and use of the trial balance:-

- Trial balance is prepared in tabular form only. It contains debit column for debit balance of accounts and credit column for credit balances of accounts.

- Only the closing balances of the accounts are shown in trial balance.

- The closing balance of stock is never shown in trial balance. It is always shown as foot note.

- Other adjustments against which no entries are passed in the books also not shown in trial balance. They are also shown as footnotes.

- The trial balance is prepared on a particular date as required by the management or at the end of thefinancial year.

- Trial balance is not an account. It is a statement only.

- The balance of all accounts is shown at one place. Thus it is the summary of all accounts.

- It shows the arithmetical mistake of the entries.

- Trading,profit and loss account and the balance sheet are prepared with the help of trial balance only.

EmoticonEmoticon