Join Our Groups

TOPIC 10: CONTROL ACCOUNT

Control Account

Control Account from Subsidiary Records

Construct control account from subsidiary records

Definition: A control account is a summary-level account in the general ledger. This account contains aggregated totals for transactions that are individually stored in subsidiary-level ledger accounts. Control accounts are most commonly used to summarize accounts receivable and accounts payable, since these areas contain a large volume of transactions, and so need to be separated into subsidiary ledgers, rather than cluttering up the general ledger with too much detailed information. The balance in a control account should match the total for the related subsidiary ledger. If the balance does not match, it is possible that a journal entry was made to the control account that was not also made in the subsidiary ledger.

The typical level of activity in a control account is on a daily basis. For example, all payables entered during one day will be aggregated from the subsidiary ledger and posted as a single summary-level number into the accounts payable control account. Posting into all control accounts must be completed before the books can be closed at the end of a reporting period; otherwise, transactions may be stranded in a subsidiary ledger.

If anyone wants to see detailed transactional information for accounts payable, they can review the detail located in the subsidiary ledger, since it is not located in the general ledger.

Control accounts are most commonly used by large organizations, since their transaction volume is very high. A small organization can typically store all of its transactions in the general ledger, and so does not need a subsidiary ledger that is linked to a control account.

Preparation of Control Accounts from Account Balance

Prepare control accounts from account balance

Whilst maintaining control accounts most businesses will maintain what is referred to as a 'memorandum.' This is a separate list of individual receivable and payable amounts due from each customer and to each supplier, respectively. This simple 'list of balances' is used as a record so that companies know how much each customer is due to pay and how much they are due to pay each supplier. This assists with credit control and cash flow management.

A key control operated by a business is to compare the total balance on the control account at the end of the accounting period with the total of all the separate memorandum balances. In theory they should be identical. This is referred to as acontrol account reconciliation.

| Balance b/f | X | Balance b/f | X |

| Credit sales (SDB) | X | Sales returns (SRDB) | X |

| Bank (CB) | X | ||

| Bank (CB) dishonoured cheques | X | Irrecoverable debts (journal) | X |

| Bank (CB) refunds of credit balances | X | Discounts allowed | X |

| Interest charged | X | Contra | X |

| Balance c/f | X | Balance c/f | X |

| ____ | ____ | ||

| X | X | ||

| ____ | ____ | ||

| Balance b/f | X | Balance b/f | X |

| Balance b/f | X | Balance b/f | X |

| Bank (CB) | X | Credit purchases (PDB) | X |

| Purchases returns (PRDB) | X | Bank (CB) refunds of debit balances | X |

| Discounts received | X | ||

| Contra | X | ||

| Balance c/f | X | Balance c/f | X |

| ____ | ____ | ||

| X | X | ||

| ____ | ____ | ||

| Balance b/f | X | Balance b/f | X |

How a Control Ledger and its Subsidiary Ledger Operate

Explain how a control ledger and its subsidiary ledger operate

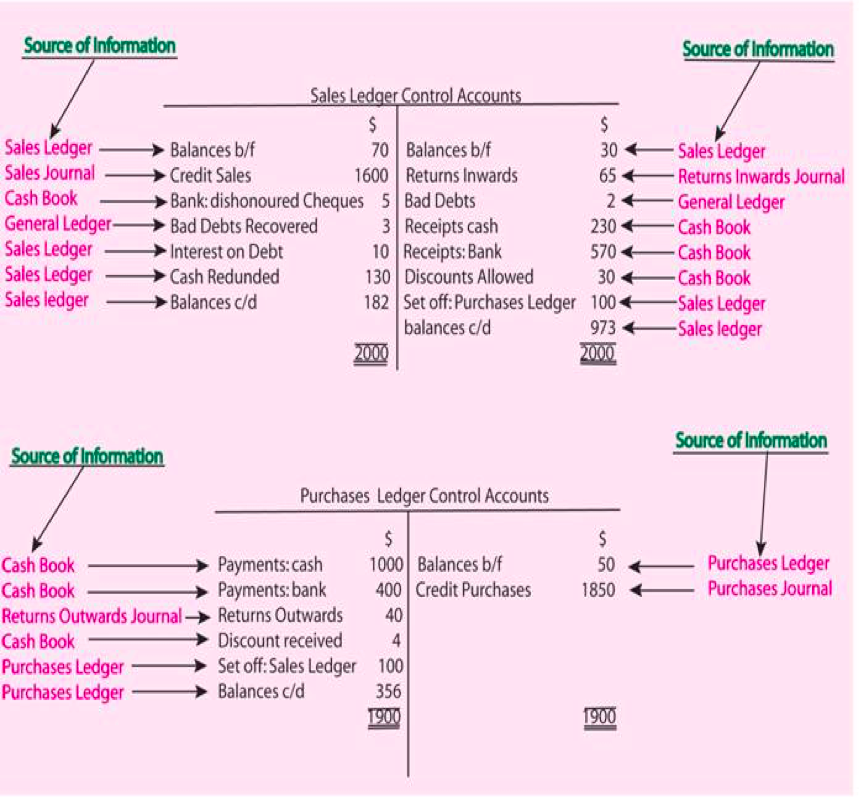

Two of the most common Control Accounts are Sales Ledger Control Accounts and Purchases Ledger Control Accounts. After posting all transactions the balance of the Control Account and the sum of the detailed records in the Subsidiary Ledger should always be the same. In other words, a control account deals with summarized information while a subsidiary ledger deals with detailed information. Because the control accounts contain summarized information they are also called total accounts. Therefore a control account for a Sales Ledger can be called a Sales ledger Control accounts or Total Debtors Account. A control account for a Purchases Ledger can be called a Purchases Ledger Control account or a Total Creditors Account.

The Rule for Posting to a Subsidiary Ledger and its Controlling Account

Give the rule for posting to a subsidiary ledger and its controlling account

The closing balances on the sales ledger control accounts should be equal to the sum total of the closing balances on the individual debtor accounts in the sales ledger. It follow as well that the closing balances on the purchases ledger control accounts should be equal to the sum total of the closing balances on the individual creditor accounts in the purchases ledger. If the respective balances are not in agreement then it would suggest some form of irregularity in the records which would need investigation.

Example 1

The information for constructing each control accounts are taken from both the personal accounts of debtors and creditors, as well as information form the main daybooks (e.g. sales daybook for total of credit sales). The main sources of information are found in the following locations:

| Information for sales ledger control account | |

| Information needed: | Information located: |

| Opening balance of debtors | Debtor accounts in sales ledger |

| Credit sales | Sales daybook |

| Returns inwards | Returns inwards daybook |

| Money received from customers | Cashbook |

| Discounts allowed | General ledger or cashbook (3rd column) |

| Closing balance of debtors | Debtor accounts n sales ledger |

| Information for purchases ledger control account | |

| Information needed: | Information located: |

| Opening balance of creditors | Creditor accounts in purchases ledger |

| Credit purchases | Sales daybook |

| Returns outwards | Returns outwards daybook |

| Money received from customers | Cashbook |

| Discounts received | General ledger or cashbook (3rd column) |

| Closing balance of creditors | Creditor accounts in purchases ledger |

A control account will appear as if it is a personal account - with amounts relating topurchases and sales, returns, discounts as well as payments made and received. The examples below are to remind you of what a debtor and what a creditor account looks like:

| Debtor accounts | |

| Balance owing to us at start | Cash/cheques received |

| Credit sales made during period | Returns inwards |

| - | Discounts allowed |

| - | Balance owing to us at end (*1) |

(*1 this is a debit balance but it is initially carried down from the credit side when the account is balanced off)

| Creditor accounts | |

| Cash/Cheques paid | Balance owing by us at start |

| Returns outwards | Credit purchases made during period |

| Discounts received | - |

| Balance owing to by at end (*2) | - |

(*2 this is a credit balance but it is initially carried down from the debit side when the account is balanced off)

Recording Corrections in the Control and Suspense Accounts

Record corrections in the control and suspense accounts

A suspense account is a temporary resting place for an entry that will end up somewhere else once its final destination is determined. There are two reasons why a suspense account could be opened:

- a bookkeeper is unsure where to post an item and enters it to a suspense account pending instructions

- there is a difference in a trial balance and a suspense account is opened with the amount of the difference so that the trial balance agrees (pending the discovery and correction of the errors causing the difference). This is the only time an entry is made in the records without a corresponding entry elsewhere (apart from the correction of a trial balance error.

Types of error

Before we look at the operation of suspense accounts in error correction, we need to think about types of error - not all types affect the balancing of the records and hence the suspense account.

Types of error

| Error type | Suspense account involved? |

| 1 Omission- a transaction is not recorded at all | No |

| 2 Error of commission- an item is entered to the correct side of the wrong account (there is a debit and a credit here, so the records balance) | No |

| 3 Error of principle- an item is posted to the correct side of the wrong type of account, as when cash paid for plant repairs (expense) is debited to plant account (asset)(errors of principle are really a special case of errors of commission, and once again there is a debit and a credit) | No |

| 4 Error of original entry- an incorrect figure is entered in the records and then posted to the correct accountExample: Cash $1,000 for plant repairs is entered as $100; plant repairs account is debited with $100 | No |

| 5 Reversal of entries- the amount is correct, the accounts used are correct, but the account that should have been debited is credited and vice versaExample: Factory employees are used for plant maintenance:Correct entry:Debit: Plant maintenanceCredit: Factory wagesEasily done the wrong way round | No |

| 6 Addition errors -figures are incorrectly added in a ledger account | Yes |

| 7 Posting errora an entry made in one record is not posted at allb an entry in one record is incorrectly posted to anotherExamples: cash $10,000 entered in the cash book for the purchase of a car is:a not posted at allb posted to Motor cars account as $1,000 | Yes |

| 8 Trial balance errors- a balance is omitted, or incorrectly extracted, in preparing the trial balance | Yes |

| 9 Compensating errors- two equal and opposite errors leave the trial balance balancing (this type of error is rare, and can be because a deliberate second error has been made to force the balancing of the records or to conceal a fraud) Yes, to correct each of the errors as discovered | Yes, to correct each of the errors as discovered |

Correcting errors

Errors 1 to 5, when discovered, will be corrected by means of a journal entry between the accounts affected. Errors 6 to 9 also require journal entries to correct them, but one side of the journal entry will be to the suspense account opened for the difference in the records. Type 8, trial balance errors, are different. As the suspense account records the difference, an entry to it is needed, because the error affects the difference. However, there is no ledger entry for the other side of the correction - the trial balance is simply amended.

Some hints on preparing suspense accounts

- Does a correction involve the suspense account? The type of error determines this. Practice, and study of Table 1 should ensure that you see immediately which errors affect the balancing of the records and hence the suspense account.

- Which side of the suspense account must an entry go? This is one of the most awkward problems in preparing suspense accounts. The best way of solving it is to ask yourself which side the entry needs to be on in the other account concerned. The suspense account entry is then obviously to the opposite side.

- Look out for errors with two aspects. In the illustrative question earlier, error 1 is a case in point. An entry has been made to the wrong account, but also to the wrong side of the wrong account. Both errors must be corrected. It is very easy to fall into the trap of correcting only one of the errors, especially when working quickly under examination conditions.

Reconciling the Sales and Purchases Ledger Control Accounts with the Individual Balances

Reconcile the sales and purchases ledger control accounts with the individual balances

The reconciliation is a working to ensure that the entries in the sales and purchase ledgers(the memorandums, or list of individual balances) agree with the entries in thecontrol accounts. The totals in each should be exactly the same. If not it indicates an error in either the memorandum account or the control account. All discrepancies should be investigated and corrected.

The format of a control account reconciliation, in this case for receivables, is as follows:

Reconciliation of individual receivables balances with control account balance

| Receivables ledger control account | |||

| $ | $ | ||

| Balance given by the examiner | X | Adjustments for errors | X |

| Adjustments for errors | X | Revised balance c/f | X |

| –– | –– | ||

| X | X | ||

| $ | |||

| Balance as extracted from list of receivables | X | ||

| Adjustments for errors | X/(X) | ||

| ––––– | |||

| Revised total agreeing with balance c/f on control account | X | ||

Illustration – Preparing a control account reconciliation

Alston's payables ledger control account is an integral part of the double entry system. Individual ledger account balances are listed and totalled on a monthly basis, and reconciled to the control account balance. Information for the month of March is as follows:

- Individual ledger account balances at 31 March have been listed out and totalled $19,766.

- The payables ledger control account balance at 31 March is $21,832.

- On further examination the following errors are discovered:

- The total of discount received for the month, amounting to $1,715, has not been entered in the control account but has been entered in the individual ledger accounts.

- On listing-out, an individual credit balance of $205 has been incorrectly treated as a debit.

- A petty cash payment to a supplier amounting to $63 has been correctly treated in the control account, but no entry has been made in the supplier's individual ledger account.

- The purchases day book total for March has been undercast (understated) by $2,000.

- Contras (set-offs) with the receivables ledger, amounting in total to $2,004, have been correctly treated in the individual ledger accounts but no entry has been made in the control account.

Step 1: The total of discount received in the cash book should have been debited to the payables ledger control account and credited to discount received. Thus, if the posting has not been entered in either double entry account it clearly should be. As this has already been entered into the individual ledger accounts, no adjustment is required to the list of balances.

Step 2: Individual credit balances are extracted from the payables ledger. Here, this error affects the ledger accounts balance. No adjustment is required to the control account, only to the list of balances.

Step 3: The information clearly states that the error has been made in the individual ledger accounts. Amendments should be made to the list of balances. Again, no amendment is required to the control accounts.

Step 4: The total of the purchases day book is posted by debiting purchases and crediting payables ledger control account. If the total is understated, the following bookkeeping entry must be made, posting the $2,000 understatement: Dr Purchases; Cr Payables ledger control account

As the individual ledger accounts in the payables ledger are posted individually from the purchases day book, the total of the day book being understated will not affect the listing of the balances in the payables ledger.

Step 5: Here it is clear that the error affects the control account, not the payables ledger. Correction should be made by the bookkeeping entry: Dr Payables ledger control account; Cr Receivables ledger control account.

EmoticonEmoticon